WH 347’s What Data is Needed and How SkillSmart Can Help You Collect It

Correctly Submitted WH 347’s – What Data is Needed?

And Here’s How SkillSmart Can Help Your Firm Collect It.

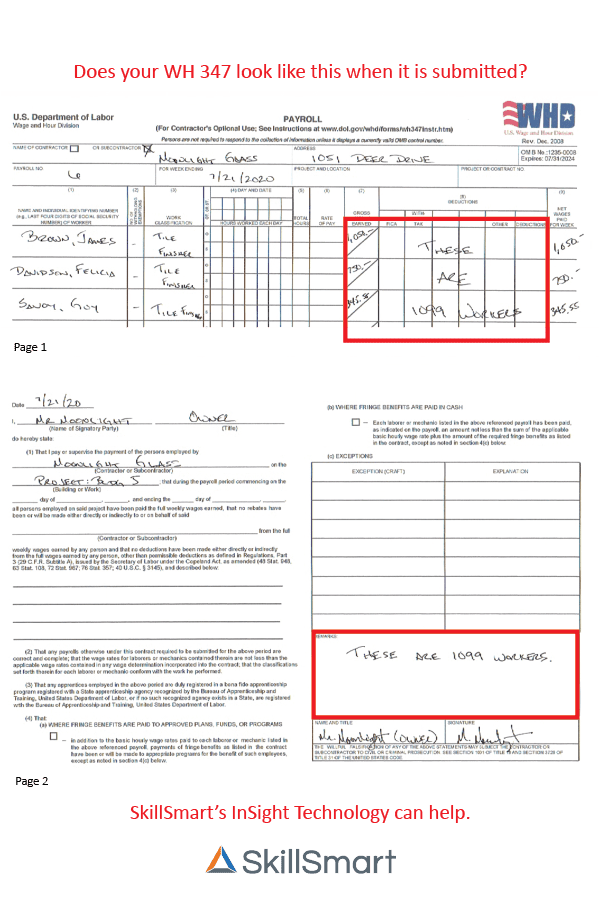

Incorrectly reporting certified payroll leads to serious consequences from the IRS. But many companies completing a WH347 form are misidentifying staff without even knowing it.

Because of confusion identifying W2 employees versus 1099 independent contractors, some companies are mistakenly submitting incorrect information – opening them up to fees and other serious consequences – often because the data with their organization’s system is not being collected or organized correctly.

– often because the data with their organization’s system is not being collected or organized correctly.

W2 Employee vs 1099 Contractor

Let’s look at the difference between a W2 employee and a 1099 contractor, as classified by the Internal Revenue Service (IRS).

Most employees in the U.S. work for a single company full or part-time and are what is known as a W2 worker or contracted employee. They get the security of consistent employment (even if it is temporary) and access to the equipment and training necessary to perform the job, but the company gets to dictate almost all the remaining terms of the arrangement, including when, where, and how the work is accomplished. As a result, these employees are given a W2 tax form at the end of each year. The employer has to pay employer taxes and withholds the employee taxes and remits to the government on behalf of the worker. Employees also get certain protections that we’ll discuss in the next section.

If you’ve ever wondered what a 1099 position means, it’s simply the classification of a worker as an independent contractor instead of an employee. An independent contractor operates as an unincorporated, individually owned business, and in many ways, these workers can be viewed as the opposite of a W2 employee. They are responsible for paying their own taxes, both at filing time and quarterly throughout the year, and holding a 1099 position means they aren’t entitled to receive any of the traditional benefits that accompany full-time employment, such as retirement plans and health insurance. There are many different types of independent contractors, but a few examples include independent owner/operators for trucking, drywall finishers, painters, flooring installers and many finish trades where manpower is at a premium.

The classification of workers is one that organizations are legally required to report to the IRS, but one that can trip up companies, based on the data they have gathered for the year.

Reporting Classifications on the WH347

The deductions recorded on the WH347 form include FICA, federal with-holding tax, state with-holding tax, medicare – all of which are not deductions for 1099 contractors.

The payroll form is also required to be signed on the last page stating the organization is correctly reporting their employees and hours paid for the last 12 months. On this final page is the area where organizations can provide an explanation for areas that were checked “other” or not filled in. This is where organizations often clarify that there are “1099 workers” listed on the form.

And this is where SkillSmart can help.

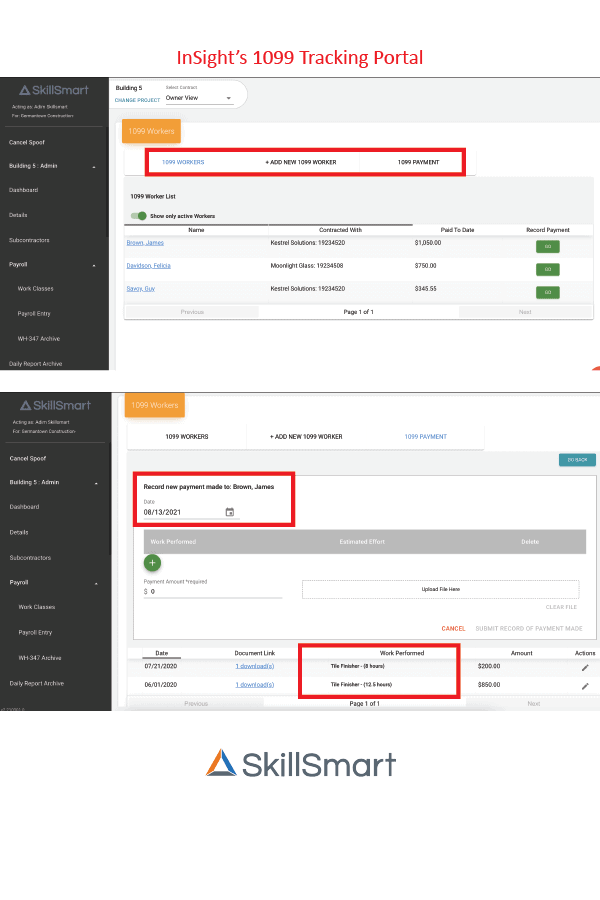

SkillSmart InSight is the ONLY comprehensive construction solution for labor and business compliance tracking. Manage one or many projects through a centralized, secure portal. Track your hours, payroll, contractor wages rates, construction data, MBE participation, supplier tracking and more. InSight is also the only software on the market that offers organizations the ability to track both W2 and 1099 contractor data, collectively or broken out, for name, address, hours worked, gender, and ethnicity.

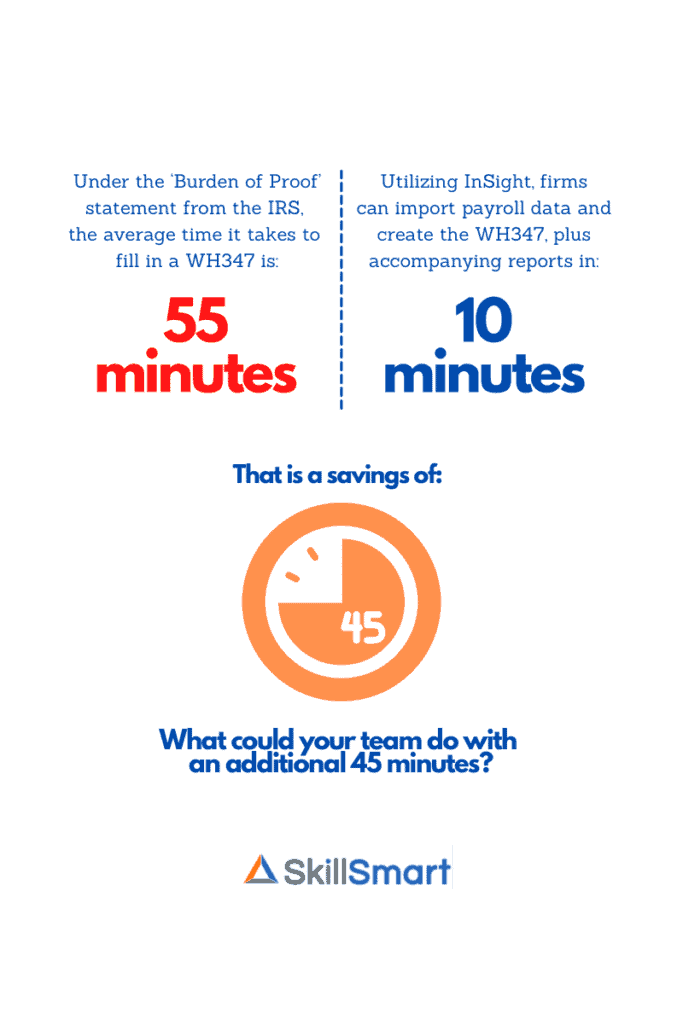

What does this mean for your Workforce Inclusion Reporting?

For the administrators collecting the data, needed to submit a WH 347 so your organization can be paid, eliminating duplicate data entry and ensuring the right data is aggregated is invaluable. Utilizing InSight, organizations have one entry point for both W2 data, collected through payroll, and 1099 data, submitted by subcontractors. By having two collection areas within the system, InSight can automatically generate the WH 347 for your team, as well as the 1099 report to accompany that, in turn giving the government entities all the information they need, in a legal and precise format.

With this accurate and aggregated data, your firm can confidently sign and submit the required forms for payment without the consequence of your business being prosecuted for falsification of documents or wrongful reporting.

The data collected goes beyond the benefits of the correct submission of WH347 forms. InSight provides organizations the ability to create  custom reports for review, analysis, and QA/QC for your team. Our team works hand in hand with your in-house experts to identify which reports will be helpful and when. For some, monthly or quarterly reports on hours worked and project status, for others, weekly reporting on payroll to proactively identify non-compliance on wage rates.

custom reports for review, analysis, and QA/QC for your team. Our team works hand in hand with your in-house experts to identify which reports will be helpful and when. For some, monthly or quarterly reports on hours worked and project status, for others, weekly reporting on payroll to proactively identify non-compliance on wage rates.

SkillSmart can help you achieve all of this.

For more information on SkillSmart or to set up a demo with our team, click here.