Top 8 Questions to Ask When You Are Researching DE&I Tracking and Labor Compliance Software

What you should know when searching for DE&I Tracking and Labor Compliance Software.

Learn MoreWhat you should know when searching for DE&I Tracking and Labor Compliance Software.

Learn MorePower Construction’s implementation of SkillSmart’s InSight technology on more than two dozen projects has allowed them to track workforce and business data and provides a clear view of how and where Power is able to make the biggest impact in the community.

Power Construction, a Chicago-based general contractor, began using SkillSmart InSight in 2019.

“We loved how SkillSmart works. Their team is flexible and open to new ideas, much more than any other company we had talked to,” said Sean Glowacz, Diversity & Inclusion Manager for Power Construction explained. “They wanted to work with the Power team to make a tool that was useful for more than an individual project. Their goal was to implement it across the entire organization.”

Site tour at the Terminal 5 Expansion and Renovation at O’Hare Airport. Hosted by Power Construction for Revolution Workshop students in Chicago, IL. Power offers site-tours through their partnerships with pre-apprentice organizations. These programs are focused on preparing local, minority, and female candidates for careers in construction trades. Photo Credit: Power Construction

InSight is deployed on more than two dozen Power projects, ranging in size from $2 million to $500 million. The technology allows Power to manage project reporting in a centralized portal, with the ability to:

Power Construction hosts Chicago Women in Trades students at their Shops at Big Deahl project site. This retail and residential development is located in the Goose Island neighborhood in Chicago, IL. Photo Credit: Power Construction

Using InSight, Power can view data in real-time on a day-to-day basis to learn more about workforce on specific project sites. Examples of data collected include subcontractor and vendor location, demographics, and financial resources.

One unexpected observation that InSight has provided Power is the ability to identify sub-tier subcontractors that they had not previously been aware of. With this knowledge, Power has invited some to participate in their subcontractor onboarding program, giving subcontractors the potential opportunity to bid Power as a prime contractor.

Unlike traditional tracking strategies utilizing payroll data and spreadsheets, InSight produces dynamic reporting metrics that inform Power of successes, shortcomings, and most importantly, where they make the biggest economic impact. SkillSmart was also able to integrate with two of Power’s software providers—CMiC and Ceridian—to assist in accurate data transfer without needing to reenter data.

Data generated by InSight provides Power additional valuable information regarding building subcontractor project teams for upcoming projects.

“When subcontractors make a commitment, Power can see there are actions behind it that are quantifiable,” Glowacz said. “Our team knows the kind of contracts they’ve let, the specifics of those contracts and the workforce being brought to the table.” Often, the most powerful partnerships occur between a subcontractor that is not minority certified but brings sub-tier participation with a diversified workforce to the project, giving Power more confidence that the subcontractor understands the purpose behind the DEI efforts.

Evanston Rebuilding Warehouse students joined Power Construction for a site tour of District 1860. Photo Credit: Power Construction

Power Construction plans to implement InSight on more projects throughout 2022, as well as utilize another SkillSmart technology, Seeker, to amplify the hiring efforts of their subcontractor partners.

To learn more about SkillSmart’s InSight technology for the construction industry, please visit: https://www.skillsmart.us/insight-demo/.

Learn More

What firms and general contractor’s should know before purchasing certified payroll reporting software for your business.

Learn MoreSkillSmart was selected by the new design-build consortium for Maryland’s Purple Line project. This project will require thousands of workers across 100+ subcontractors and their tiers. As part of the project, all companies must comply and demonstrate compliance with the established wage rates for each trade and County. The Purple Line will use SkillSmart’s InSight technology to engage all of the subcontractors and their tiered subs, tracking all required reporting data and enabling real-time reporting.

SkillSmart was enlisted at the start of the Purple Line project in 2019, so the project team could take advantage of the software’s powerful features. These features, outlined below, are the same elements that will be used to track the construction data for this project.

Submit and track monthly payroll. Contractors and tiered subcontractors use SkillSmart InSight to enter and gather the data they need to ensure project requirements are met.

Centralized reporting. The team will be able to have this data at their fingertips in one, simplified dashboard.

This 16-mile, $9.3B, light rail project is estimated to be completed in 2026. To read more about the Purple Line project, click here: https://www.purplelinemd.com/about-the-project/overview

Learn More

Our team took the opportunity to highlight nearly all of the areas that the construction industry either should be focused on or are already getting a head-start on elevating these areas within their organizations and how SkillSmart’s technology platform, InSight, can help your firm with all of it.

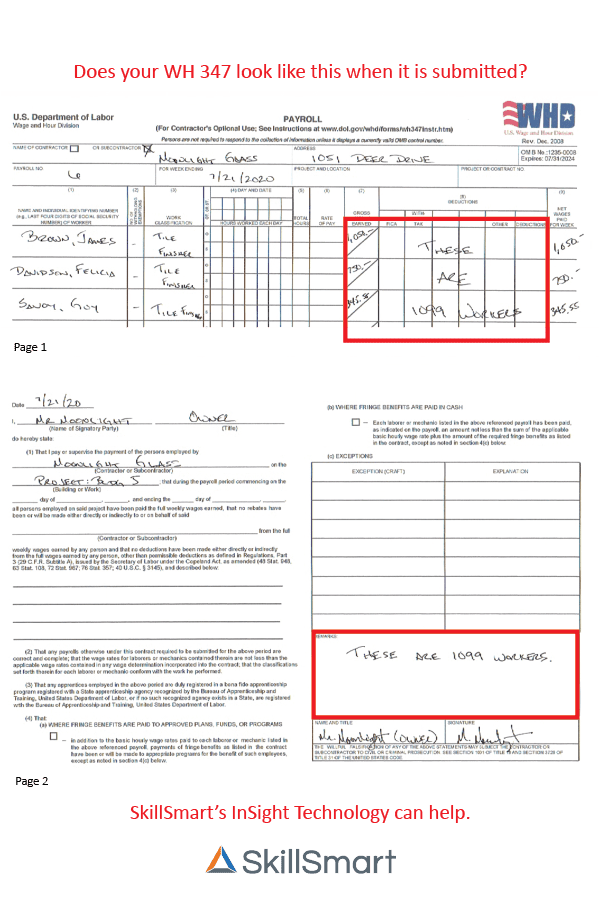

Learn MoreCorrectly Submitted WH 347’s – What Data is Needed?

And Here’s How SkillSmart Can Help Your Firm Collect It.

Incorrectly reporting certified payroll leads to serious consequences from the IRS. But many companies completing a WH347 form are misidentifying staff without even knowing it.

Because of confusion identifying W2 employees versus 1099 independent contractors, some companies are mistakenly submitting incorrect information – opening them up to fees and other serious consequences – often because the data with their organization’s system is not being collected or organized correctly.

– often because the data with their organization’s system is not being collected or organized correctly.

W2 Employee vs 1099 Contractor

Let’s look at the difference between a W2 employee and a 1099 contractor, as classified by the Internal Revenue Service (IRS).

Most employees in the U.S. work for a single company full or part-time and are what is known as a W2 worker or contracted employee. They get the security of consistent employment (even if it is temporary) and access to the equipment and training necessary to perform the job, but the company gets to dictate almost all the remaining terms of the arrangement, including when, where, and how the work is accomplished. As a result, these employees are given a W2 tax form at the end of each year. The employer has to pay employer taxes and withholds the employee taxes and remits to the government on behalf of the worker. Employees also get certain protections that we’ll discuss in the next section.

If you’ve ever wondered what a 1099 position means, it’s simply the classification of a worker as an independent contractor instead of an employee. An independent contractor operates as an unincorporated, individually owned business, and in many ways, these workers can be viewed as the opposite of a W2 employee. They are responsible for paying their own taxes, both at filing time and quarterly throughout the year, and holding a 1099 position means they aren’t entitled to receive any of the traditional benefits that accompany full-time employment, such as retirement plans and health insurance. There are many different types of independent contractors, but a few examples include independent owner/operators for trucking, drywall finishers, painters, flooring installers and many finish trades where manpower is at a premium.

The classification of workers is one that organizations are legally required to report to the IRS, but one that can trip up companies, based on the data they have gathered for the year.

Reporting Classifications on the WH347

The deductions recorded on the WH347 form include FICA, federal with-holding tax, state with-holding tax, medicare – all of which are not deductions for 1099 contractors.

The payroll form is also required to be signed on the last page stating the organization is correctly reporting their employees and hours paid for the last 12 months. On this final page is the area where organizations can provide an explanation for areas that were checked “other” or not filled in. This is where organizations often clarify that there are “1099 workers” listed on the form.

And this is where SkillSmart can help.

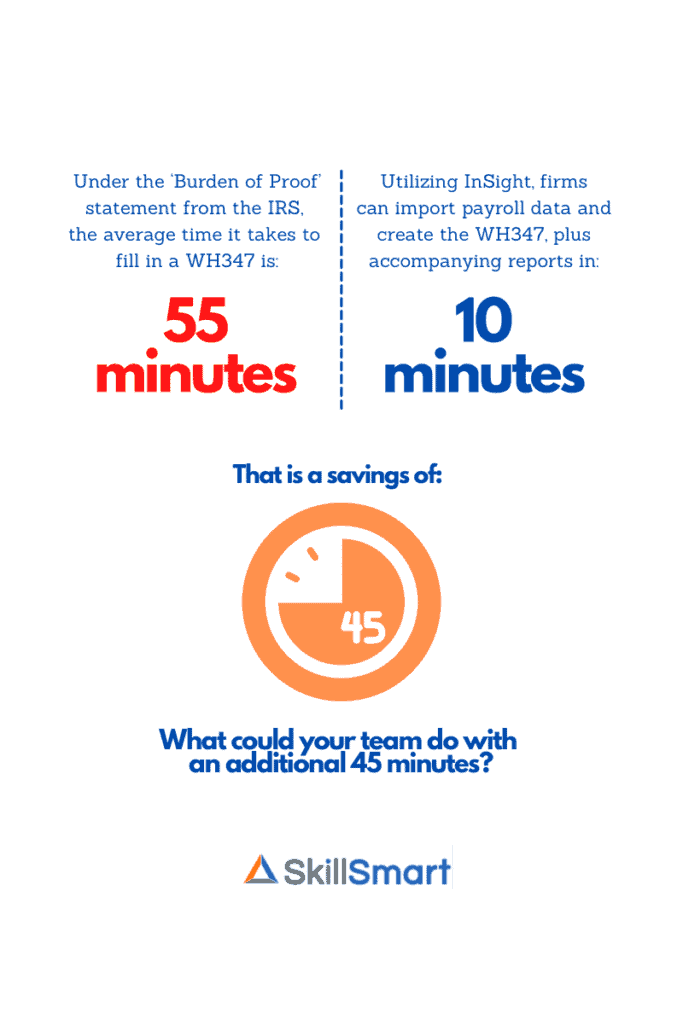

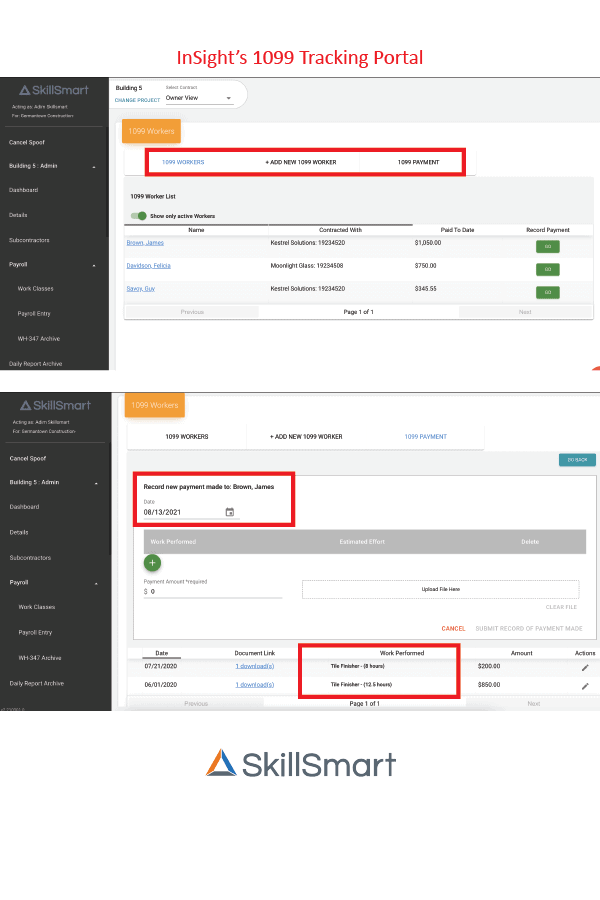

SkillSmart InSight is the ONLY comprehensive construction solution for labor and business compliance tracking. Manage one or many projects through a centralized, secure portal. Track your hours, payroll, contractor wages rates, construction data, MBE participation, supplier tracking and more. InSight is also the only software on the market that offers organizations the ability to track both W2 and 1099 contractor data, collectively or broken out, for name, address, hours worked, gender, and ethnicity.

What does this mean for your Workforce Inclusion Reporting?

For the administrators collecting the data, needed to submit a WH 347 so your organization can be paid, eliminating duplicate data entry and ensuring the right data is aggregated is invaluable. Utilizing InSight, organizations have one entry point for both W2 data, collected through payroll, and 1099 data, submitted by subcontractors. By having two collection areas within the system, InSight can automatically generate the WH 347 for your team, as well as the 1099 report to accompany that, in turn giving the government entities all the information they need, in a legal and precise format.

With this accurate and aggregated data, your firm can confidently sign and submit the required forms for payment without the consequence of your business being prosecuted for falsification of documents or wrongful reporting.

The data collected goes beyond the benefits of the correct submission of WH347 forms. InSight provides organizations the ability to create  custom reports for review, analysis, and QA/QC for your team. Our team works hand in hand with your in-house experts to identify which reports will be helpful and when. For some, monthly or quarterly reports on hours worked and project status, for others, weekly reporting on payroll to proactively identify non-compliance on wage rates.

custom reports for review, analysis, and QA/QC for your team. Our team works hand in hand with your in-house experts to identify which reports will be helpful and when. For some, monthly or quarterly reports on hours worked and project status, for others, weekly reporting on payroll to proactively identify non-compliance on wage rates.

SkillSmart can help you achieve all of this.

For more information on SkillSmart or to set up a demo with our team, click here.

Learn MoreThe $1.2T infrastructure bill marks one of the most significant investments in the country’s infrastructure since Congress responded to the Great Recession.

The bill, signed into law on Monday, November 15, will send billions of dollars to states and local jurisdictions, over the next five years. More than $110 billion will be directed to replace and repair roads, bridges, and highways, and $66 billion to boost rail, making it the most substantial such investment in the country’s passenger and commercial network since the creation of Amtrak. In addition, lawmakers provided $55 billion to improve the nation’s water supply and replace lead pipes, $60 billion to modernize the power grid and expand broadband and other public works projects.

This means the biggest impacts of this bill will be felt by those in the construction industry and the communities where the resources will be spent. Some reports are estimating that this could create 1 million jobs over the course of five years.

Clearly, this is an incredible opportunity for those contractors who typically bid on projects with public-funding, and given the scale, this represents a new market for those firms who haven’t. So, what does that mean for the industry’s that will be charged with putting this money to work?

The ability to demonstrate the economic impact of this funding and the specific individual projects is going to be paramount for both the funders and the contractors. There is a continuation of the existing disadvantaged business enterprise (DBE) program to address race and gender discrimination in surface transportation related business. Funded projects must have at least 10 percent of the work provided to small business concerns owned and controlled by socially and economically disadvantaged individuals. Additionally, there are requirements to ensure prompt payments to DBE contractors. Finally, projects receiving any funds must ensure they are paying prevailing wages to those workers on the project.

To ensure that the funds are both building the infrastructure, as well as having the desired economic impact across the country, it will be important for projects to capture information about business participation, labor demographics, and prevailing wages in order to demonstrate these positive benefits.

You can’t manage what you can’t measure. The key to ensuring full access to the benefits of this bill is data tracking and reporting. This shouldn’t sound new, as it is a refrain that projects owners, both public and private, have been saying for some time, but the demands of the Infrastructure Bill are absolutely amplifying the importance of data collection, monitoring, and reporting to ensure equitable and inclusive projects.

This is an opportunity that shouldn’t be missed. Here are three things to consider before this funding starts flowing into your project pursuit pipeline:

SkillSmart will be digging into this bill over the next few months, providing a deeper dive into:

If you are interested in discussing any of the information above or how SkillSmart can support your team with tracking, managing, and reporting your project data, please contact Joshua Lowery (jlowery@skillsmart.us).

Learn MoreTechnology is supposed to make your construction projects faster, easier and cheaper – Right? Except that every task has its own technology application. So, now you and your subcontractors have to log on to multiple systems, learn different programs that don’t talk to each other, and end up spending more time than you did before all this technology made your life easier! For example, when it comes to tracking, managing and reporting on business expenditures and workforce efforts, you can often use multiple software applications, at least one internal compliance manager on your staff, and an external consultant to pull it all together for your monthly reports.

SkillSmart’s InSight platform can help connect the dots, and begin to make life a whole lot easier. InSight combines your ability to capture business and workforce data for all of your projects in a single platform. It also pushes the data entry process down to each of the subcontractors on every tier so that all the data rolls up to the GC to track, manage and report – providing much greater transparency and accuracy into the entire process… and make it easier to manage. It also provides dynamic reporting so that you can easily check your dashboard for any and all projects to see how much progress is being made. The InSight platform can also pull in data from your other internal applications reducing time and errors. Finally, it can generate the reports you need with one click.

We believe that doing the right thing shouldn’t make your life and job more difficult – so we’re working hard to making things simpler for you where we can.

Learn MoreMany new developments and construction projects are compelled to track how many small and diverse businesses are working on their project along with how many local and diverse residents are employed by the contractors working on the project. Much of the time, this tracking and reporting is done because the projects have some public participation – tax credits, public financing, land use approvals – but there are also projects that track and use this information because the recognize it increases the value of their project. Tracking these efforts are important because they can help to quantify the economic value that these projects have in their community. Unfortunately, this process has always been difficult and cumbersome. Often it has just been a compliance effort on the part of the projects and jurisdictions – a box that needs to be checked. The broader, very important, story is rarely told.

SkillSmart’s new InSight platform has been designed to achieve both of these functions – simply and dynamically meet the compliance requirements and provide usable data to tell the exciting story of the project impact.

As important, this data and associated tools help developers, GCs, and subs to make better decisions, hire stronger partners and employ better workers.

Now it’s easier for construction projects to get and stay compliant with their business and workforce requirements, and for all projects to demonstrate why they are beneficial for their communities by strengthening local businesses and residents.

Learn MoreLast year, Maryland’s General Contractor Liability for Unpaid Wages Act took effect providing an employee with the right to sue both their employer and the general contractor for the job on which they’re working for up to three times the wages owed to the employee, plus attorneys’ fees and costs. Perhaps even more significant is that this new law permits an employee to take such action as early as 2 weeks after the date on which the wage in question was to have been paid.

Failure to comply with Maryland’s prevailing wage and hour laws now exposes general contractors and subcontractors to significantly greater liability than before.

Now, more than ever, it is vitally important for both GCs and Subs to have the ability to track, validate and report, in real time, that each employee working on a project is being paid the appropriate wage.

Email and Excel spreadsheets are no longer sufficient. They do not provide the timely safeguards you need to preserve project margins from unnecessary risk and litigation.

At SkillSmart, we understand the difficulty in tracking the data necessary to prove compliance with this new law. We also recognize the need for a simple and cost-effective solution.

Working with contractors on large and small projects across the country, we developed the InSight platform to allow subcontractors to submit their own payroll information and, in one-click, see if there are any compliance issues that require follow-up, and the audit trail to back it up. This provides everyone working on a job with a single, secure location to input employee and payroll data, ensuring data is being provided at the source and all parties are working on the same page.

SkillSmart InSight helps you focus on the project at hand by providing a simple, cost-effective solution to help you better manage potential liabilities in real-time and making it easier to stay compliant.

Learn more about how InSight can help you simplify your compliance efforts.

Request a Demo

Learn More